Is Now the Time to Invest in China's Tech Growth? Exploring a Unique Opportunity of the Decade

- Carlos Lorenzo

- Nov 5, 2024

- 5 min read

Investing in Chinese technology companies could make many investors millionaires in the coming years. China’s expanding consumer market, technological innovation, and government support have positioned its companies to become global leaders in the tech field. Below, we analyze why China represents one of the biggest global investment opportunities and explore financial instruments that facilitate investment in this sector, including Chinese tech ETFs.

The Rise of China’s Technology Market

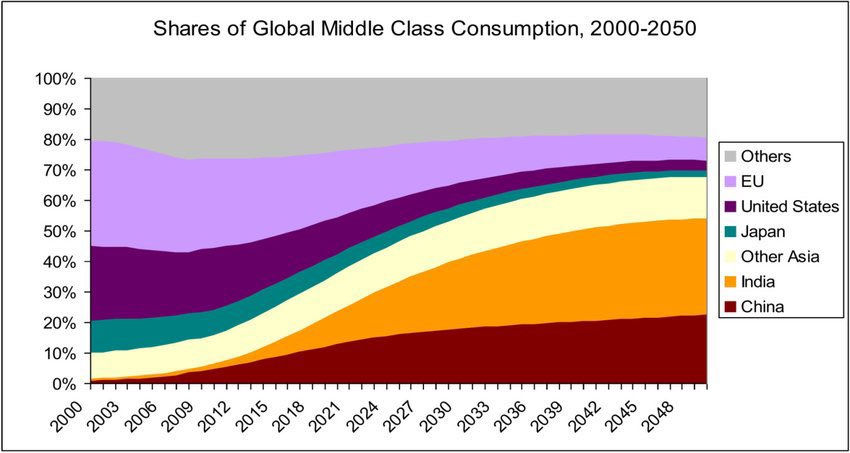

China has emerged over the past decade as one of the world’s leading technology powers. With a rapidly expanding middle class projected to reach 800 million people by 2030, China stands as an economic powerhouse with immense consumer potential. This social and economic transformation not only drives domestic growth but also positions China to challenge the dominance of the United States in the technology sector.

Despite government controls and a communist political model, China’s business ecosystem has aggressively embraced capitalism, enabling the rise of ambitious entrepreneurs and the creation of substantial wealth. Many analysts believe that China is, in fact, one of the most capitalist countries in the world in terms of wealth generation and the growth of its tech giants, also known as "Big Tech."

China has demonstrated a unique capacity for adaptation and innovation in the tech sector. Currently, the country leads in patents related to artificial intelligence, robotics, and other high-tech areas. Chinese companies are not only on par with their U.S. counterparts in many technological areas but are even outpacing them in certain key sectors, such as industrial automation and electric vehicles.

Xiaomi: Automation and Robotics in Vehicle Manufacturing

A clear example of China’s technological capabilities is Xiaomi. In one of its fully automated factories, Xiaomi employs 700 robots to assemble an electric vehicle every 76 seconds, with no direct human intervention in the central manufacturing processes. This level of automation showcases the technological progress and efficiency Chinese companies are achieving compared to their global counterparts.

BYD: Innovation in Electric Vehicles

Another notable example in China’s tech landscape is BYD. This company has become the world’s largest manufacturer of electric vehicles in terms of units sold, thanks to its focus on robotic manufacturing processes. BYD’s dominant market position reflects the ability of Chinese companies to innovate in high-tech sectors and compete on a global scale.

One of the most attractive aspects of Chinese tech companies is their valuation. Chinese companies trade at significantly lower price-to-earnings (P/E) multiples compared to their U.S. counterparts, making their shares appear inexpensive by comparison. While the average P/E ratio for U.S. tech firms hovers around 24, in China this average is about 8, suggesting significant growth potential considering the projected economic expansion and ongoing technological development.

This valuation difference creates a potentially lucrative investment opportunity, especially given that many of these companies have shown revenue and earnings growth. Below, we analyze two specific examples of Chinese tech companies: Baidu (BIDU) and Alibaba (BABA).

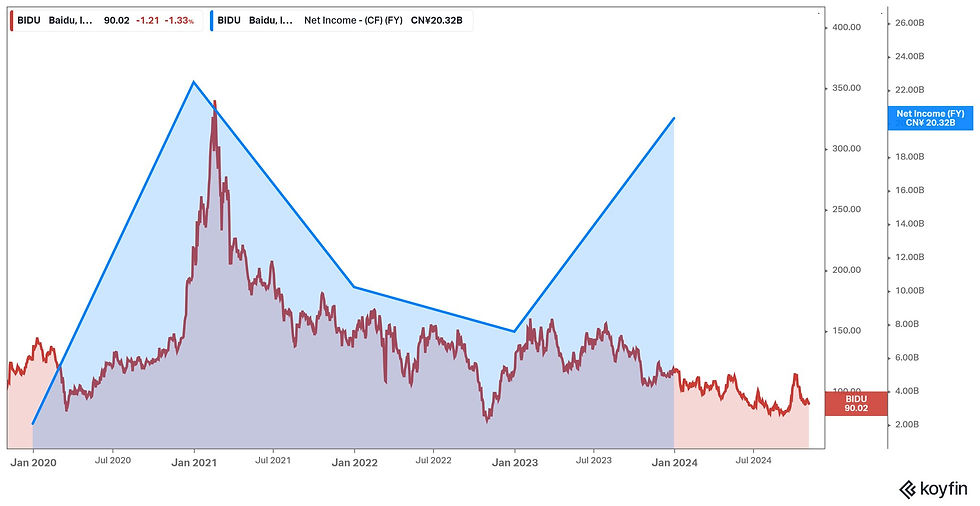

Baidu (BIDU)

From 2011 to 2024, Baidu’s annual revenue grew from $1.16 billion to approximately $18 billion, representing an increase of over 15 times. However, the stock price remains at similar levels to 2011, suggesting that the market has not fully reflected its growth in value. This valuation gap compared to its revenue growth could make Baidu an attractive investment in the coming years.

Alibaba (BABA)

Alibaba is another standout example of growth without a corresponding valuation increase. Since its IPO in 2014, Alibaba’s annual revenue has risen from $12.3 billion to approximately $126 billion in 2023. Despite this tenfold revenue growth, Alibaba’s shares currently trade below their IPO price. This situation highlights an investment opportunity for those interested in benefiting from Alibaba’s growth without paying a high premium.

The Chinese government has taken significant steps to stimulate the economy and overcome challenges in the real estate sector and slowing economic growth. Recently, China implemented massive economic stimulus measures comparable to the rescue programs adopted by the U.S. during the COVID-19 pandemic. These measures include:

Reduction in interest rates

Injection of $142 billion

Relaxation of banking policies

These economic stimulus policies could strengthen China’s economy and provide additional momentum to the country’s tech companies. Government intervention in the economy also suggests that the Chinese stock market could receive a "tailwind," benefiting both domestic and international investors.

Chinese Tech ETFs: A Diversified Investment Option

Exchange-Traded Funds (ETFs) allow investors to purchase a diversified basket of assets, in this case, shares of Chinese tech companies, through a single financial product. Investing in an ETF offers several advantages, including risk diversification, ease of buying and selling, and generally lower fees compared to buying individual stocks. ETFs are managed by large financial companies and are designed to replicate the performance of a specific index.

The Power of Compound Interest

One of the greatest benefits of investing in ETFs, especially in high-growth sectors like Chinese tech, is the potential of compound interest. This effect occurs when the earnings generated by an investment are reinvested, allowing returns to accumulate over time. This can result in exponential growth of the initial investment over the long term, particularly in sectors experiencing accelerated growth.

Several ETFs focus on Chinese technology companies, each with unique characteristics and strategies. Here are some of the most prominent:

KraneShares CSI China Internet ETF (KWEB) – ISIN: US5007674050One of the most popular ETFs focusing on Chinese internet and technology companies. It includes shares of companies like Alibaba, Tencent, and Baidu. Its goal is to replicate the performance of the CSI Overseas China Internet Index, making it an ideal choice for those seeking exposure to major Chinese internet companies.

iShares MSCI China ETF (MCHI) – ISIN: US46429B6717This ETF provides broader exposure to the Chinese market, including both tech and other large-cap companies. However, it maintains a significant weighting in the tech sector, allowing it to benefit from growth trends in this area.

Global X MSCI China Information Technology ETF (CHIK) – ISIN: US37954Y2917This ETF focuses exclusively on China’s technology sector, offering exposure to a broader set of companies, from tech giants to emerging firms. Its goal is to capitalize on growth in the Chinese tech sector across the board.

Invesco China Technology ETF (CQQQ) – ISIN: US46137V3810This ETF targets Chinese tech and telecommunications companies. It includes some of China’s largest consumer technology companies and aims to capture growth in innovation and digitalization.

The attention of major international investment firms on the Chinese market has been notable. For instance, JP Morgan, in a recent study, indicated that the Chinese stock market may have bottomed out, with significant recovery potential in the coming years. Following previous recovery cycles, such as +359% from 2004 to 2008 and +151% from 2014 to 2015, growth expectations are encouraging for investors interested in this market.

Investing in Chinese technology companies could represent one of the most significant investment opportunities of the decade. With an expanding economy, a growing consumer market, and government support, China’s tech sector offers immense growth potential for investors willing to embrace this emerging market.

Comments